Case Study

Strategic Transformation in Compliance Management

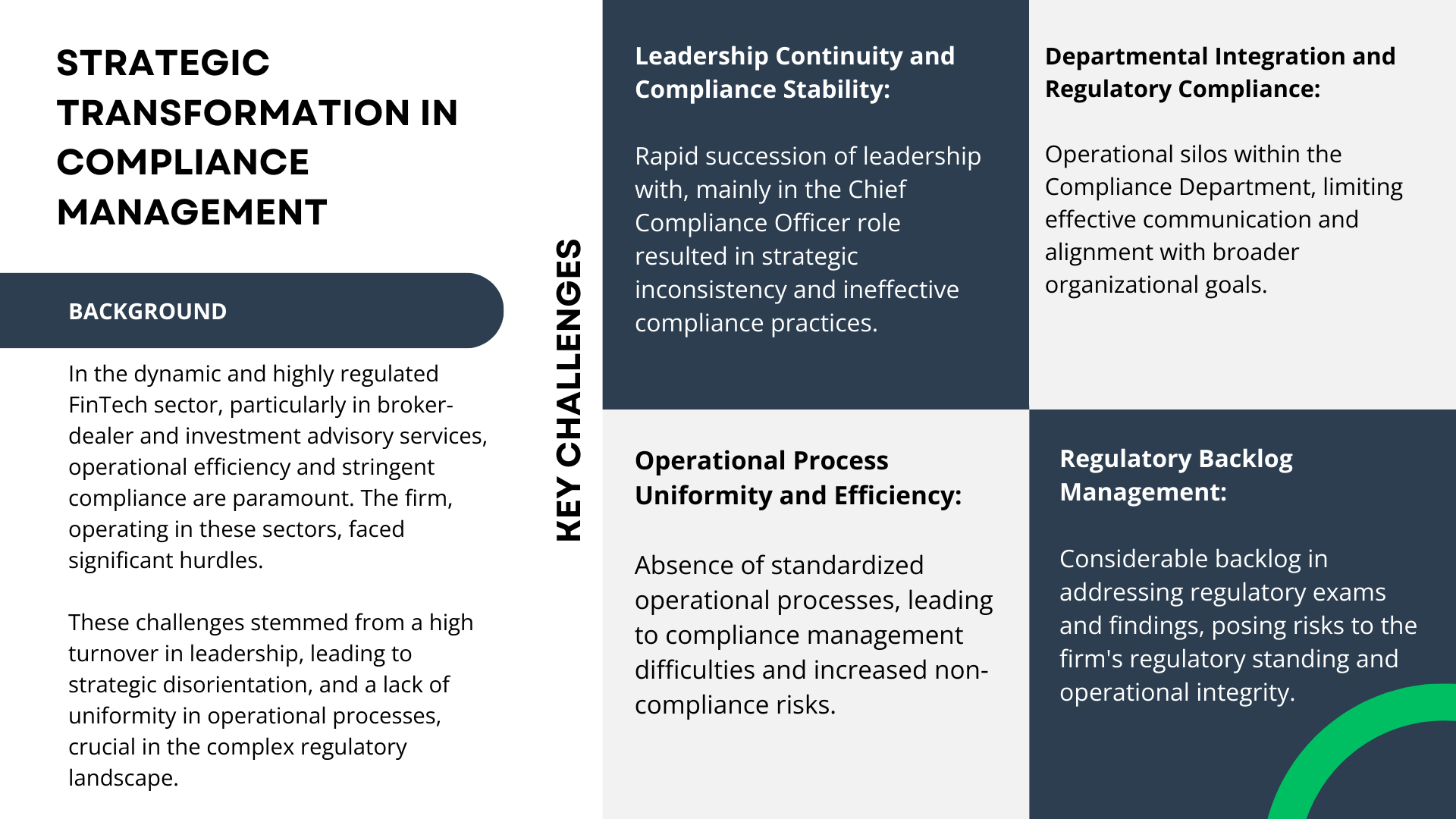

The case study delves into the unique challenges faced by the firm, particularly in maintaining operational efficiency and regulatory compliance in the dynamic and complex spheres of broker-dealer and investment advisory services. It outlines the strategic solutions I implemented, including the development of a compliance roadmap, integration of advanced technology, and establishment of robust operational processes. The outcomes of these interventions were transformative, leading to streamlined operations, enhanced regulatory compliance, a unified compliance team, and a scalable compliance framework.

-

Approach: Initiated with a thorough analysis to identify and categorize compliance issues specific to broker-dealer and investment adviser regulations. This comprehensive assessment provided a foundational understanding of the prevailing compliance landscape and the specific needs of our firm.

Implementation:

Strategic Roadmap Creation

Categorized Initiatives and Projects

Training Programs

Feedback Loop and Open Communication

Roadmap Management Process

Executive Reporting Tools

Stakeholder Engagement and Transparency

Internal Resource Site

Governance of Compliance Projects

Outcome: The implementation of this strategic compliance roadmap resulted in a clear, actionable plan that systematically improved compliance processes. This led to a more streamlined and efficient operational framework, aligning closely with industry-specific regulations. It not only addressed immediate regulatory requirements but also laid a foundation for sustainable compliance management and continuous improvement in the ever-evolving landscape of financial services regulation.

-

Approach: Initiated by tackling the backlog and inefficiencies in the handling of regulatory exams, this strategy was specifically tailored to the distinct regulatory needs of the broker-dealer and investment adviser sectors.

Implementation:

Regulatory Exam Management Process

Tracking System for Regulatory Exams

Retrospective Analysis for Findings

Project Management for Exam Findings

Exam Lookback Initiative

Outcome: The streamlined process for regulatory exam management led to marked improvements in response times and accuracy. The reduction in the backlog, coupled with the successful implementation of the Exam Lookback Initiative, significantly enhanced the firm's regulatory standing. This multi-faceted approach not only resolved current compliance issues but also fortified the firm’s capacity to manage future regulatory challenges efficiently, thereby upholding its commitment to stringent regulatory compliance and operational excellence.

-

Approach: Initiated with the recognition of the need for a more agile and responsive policy review process. This was identified as a critical component in ensuring the firm's ability to quickly adapt to the rapidly changing regulatory landscape, particularly for broker-dealers and investment advisers.

Implementation:

Process Overhaul for Policy Review and Update

Utilization of Advanced Technology Solutions

Compliance Committee Involvement

Subsequent Training and Dissemination

Outcome: The refinement of the policy update mechanism and the establishment of the enterprise policy adoption process significantly enhanced the firms ability to maintain compliance and reduce the risk of regulatory breaches. By leveraging advanced technology for efficient policy management and ensuring thorough vetting and training, the firm not only kept pace with regulatory changes but also fostered a culture of proactive compliance. This approach not only addressed immediate compliance needs but also reinforced the firm's long-term commitment to regulatory adherence and operational integrity.

-

Approach: Initiated with the recognition of the necessity for proactive regulatory filing management. This approach was vital in enhancing the firm's compliance framework, especially considering the intricate regulatory schedules in the broker-dealer and investment adviser sectors.

Implementation:

Comprehensive Compliance Calendar

Integration with Prior Technology Solutions

Regular Updates and Alerts

Training on Calendar Utilization

Outcome: The introduction of the comprehensive compliance calendar significantly improved the management of regulatory obligations, ensuring they were systematically addressed and on time. This enhancement of the firm’s compliance posture was achieved by not only keeping track of compliance activities but also by integrating the calendar with the previously established technological framework. The proactive management approach fostered by this initiative helped the firm meet current regulatory demands and positioned it to adeptly handle future regulatory changes, reinforcing a strong and enduring compliance culture.

-

Approach: The project commenced with an analysis recognizing the need for advanced technology to automate key compliance tasks, focusing on the specific requirements of broker-dealers and investment advisers.

Implementation:

Customized Technology Solutions

Integration of Workflows into a Unified System

Collaboration and Process Innovation

Feedback Loop Integration

Training and Development Across Departments

Outcome: The project significantly reduced manual workload and improved accuracy in compliance reporting, thereby enhancing regulatory compliance and operational efficiency. The success of this integration underscored the importance of leveraging technology in compliance management, demonstrating a commitment to operational excellence and adherence to regulatory standards in the financial services industry.

A Strategic Solution Spotlight

This diagram is an insightful look into one of the Strategic Solutions that showcases the seamless integration of technology to enhance Compliance and Operational procedures. Discover how a carefully curated Tech Stack has revolutionized process efficiency.

Conclusion

The outcomes of this strategic intervention—a streamlined operational framework, enhanced regulatory compliance, a unified and proactive compliance team, increased process efficiency, and a robust, adaptable compliance structure—demonstrate not only the resolution of immediate issues but also the establishment of a sustainable foundation for future growth.

This transformation transcended mere compliance adherence, fostering a culture of efficiency, proactive regulation management, and integrated team dynamics. It significantly contributed to positioning the firm for ongoing success and adaptability in the dynamic and evolving landscape of financial services. This case study serves as a testament to the critical role of strategic, holistic solutions in achieving operational excellence and regulatory robustness in the complex world of FinTech.